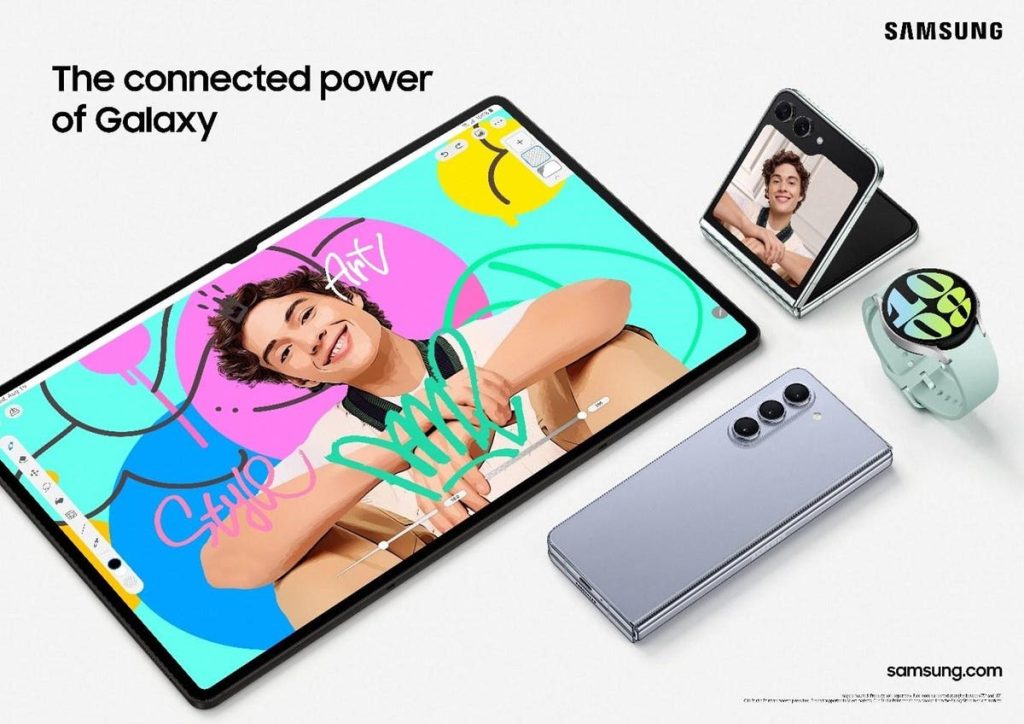

Samsung’s annual cadence has always been to launch two different sets of devices every year. First, it was the Galaxy S series in the spring followed by the Note series in the Fall. Those timelines have slightly changed in the last few years, with the Galaxy S series becoming a late winter launch and the Note series being replaced by the Galaxy Z foldable series in the late summer/early fall. This year, we’re getting a full refresh of the Galaxy Z series and a refresh of the Galaxy Watch and Tab series at the same time.

All these models are shipping from Samsung with the latest processors from Qualcomm: the Snapdragon 8 Gen 2 for Galaxy. The only exclusion here is the Galaxy Watch6 series, which features Samsung’s new W930 dual-core processor clocked at 1.4 gigahertz (an improvement over the 1.18 gigahertz of the W920).

Galaxy Z Fold5 and Flip5

Samsung has implemented a new hinge design for the Galaxy Z Flip and Z Fold series that enables the phones to close flush when folded. This enables a cleaner and thinner design, which many of Samsung’s competitors already have on the market. Without a doubt, Samsung has pioneered in the foldable market like nobody else, but it has also lagged in enabling key features such as improved hinge design and larger outer displays. The Flip now features a 3.4-inch outside cover screen, albeit with a lower resolution than Moto’s Razr+, which features a 1,066 x 1,056 resolution on a 3.6-inch display with two seamlessly cut-out cameras.

I was really hoping that Samsung, the world leader in displays, would include a screen on its new phones that would compete with Motorola’s and I’ve got to be honest: I don’t think it has happened. With the camera cut-out, Samsung’s 3.4-inch display looks even smaller than it is, and it still has far fewer pixels per inch than Motorola. That outer screen is how most people first experience the Flip5, so I believe failing to upgrade this display was a mistake.

I also believe that Samsung’s decision to make 256GB of storage the default for the Flip5 and Fold5 comes in response to Moto’s move to give the Razr+ 256GB. I also believe it was a mistake for Samsung to offer only 8GB of RAM on the 512GB model because it’s already charging a premium for the extra storage. Motorola also offers 30-watt charging on the Razr+, while Samsung only offers 25-watt, both of which seem pedestrian when you consider that some phones are offering 200-watt charging. I would love to see both companies offer faster charging standards such as QuickCharge 5.0, which is faster, more efficient and offers up to 100-watt charging.

The Flip5 will always be Samsung’s most popular device at $999, focuing on content creation and consumption rather than productivity and content consumption like the more expensive Fold5. It will be interesting to see how the Flip5’s battery life is affected by a 3,700 mAh battery with a Snapdragon 8 Gen 2 versus the 3,800 mAh battery with a Snapdragon 8+ Gen 1 in the Moto Razr+. It also seems that the Flip5 has a lower-resolution front-facing camera (10 megapixels) than the Razr+ (32 megapixels), but I suspect it won’t be a big deal, because I believe that most selfies will be taken with the main camera using the cover screen. Or, at least, that’s how I’ve been using all of my foldables.

I think Samsung might benefit from offering a less powerful SoC—as Motorola did on the Flip5—because most consumers won’t care about the processor as much as the cameras, displays and storage. The Snapdragon 8 Gen 2 is a great processor, but it might inhibit Samsung’s ability to compete at the $999 price point, which has become the battleground for most flip-phone-style foldables. That said, the main cameras are still very competitive with the rest of the foldable market, even though I’d like to see higher resolutions closer to what we see in candy-bar phones. The lack of flagship camera configurations on foldables is one of the factors why I haven’t fully made the switch yet.

Simply put, the Flip5 has more competition than ever, and I think Samsung is going to have a lot harder time selling the Flip5 with competitors like the Razr+ and Oppo’s Find N2 Flip. In my opinion, the price point where the Flip5 lives is the most competitive niche in the market, where consumers have the most choices and companies need to make the savviest of compromises.

For the Fold5, Samsung has more competition from the likes of Xiaomi, Oppo and Vivo in China and Europe, but lacks real competition in the U.S., with only the Google Pixel Fold to challenge it. The Pixel Fold is Google’s first-generation foldable, and it shows. Google is shipping a device whose chipset, modem and display are inferior to Samsung’s last-generation foldable, and while the Google product does have some of the software optimizations and features that Samsung has now, it really feels quite lacking in design and function—especially with both devices selling for $1,799.

Samsung has the undisputed lead here, but I think it has a lot more competition outside the United States from the Chinese OEMs. Vivo’s X Fold 2, Xiaomi’s Mix Fold 3 and Oppo’s Find N2 all create a much more complex market dynamic. This is not to mention Huawei, even though Huawei’s Mate X3 doesn’t have 5G or the Google Play store. Samsung is still the king of global foldables, and when it comes to software and productivity the Fold5 is still king, especially with the improved hinge and faster processor.

My biggest gripe—other than it being nearly identical to the Fold4—is that Samsung’s under-screen front-facing camera is only 4 megapixels and will likely be borderline unusable like it was in the Fold4 because the image quality is so bad and there’s so much AI retouching. That said, as I noted for the Flip5, there aren’t many scenarios other than video calling where you will want to use the inside screen’s camera for selfies. Samsung has also held off on integrating the S Pen into the Fold5 for yet another generation, rendering it considerably less useful. The slight upside is that it’s now offering a new slimmer S Pen and case combo.

I am similarly disappointed by the Fold5’s 25-watt charging, especially when it has a 4,400 mAh battery, which I believe should be bigger considering the 7.6-inch internal and 6.2-inch external displays. I also believe that the Fold5’s triple camera configuration is competitive with the rest of the industry’s foldable offerings, but I’d love to see it be closer to what Samsung offers on the S23 Ultra phone, especially at $1,799.

Overall, the Flip5 and Fold5 do a lot to keep Samsung competitive today, but I wouldn’t necessarily say that Samsung has introduced any innovations that change the trajectory of the market. I would love to see the S Pen finally integrated into the Fold5; more than that, I want to see improved cameras across the board, because I can’t bring myself to drop my candy-bar phones for a foldable with an inferior camera system. Also, I don’t understand Samsung’s strategy of offering inferior charging on its foldables when it has 45-watt charging on devices like the S23 Ultra. Simply being on par with the S23 isn’t good enough, especially since the Flip5 and Fold5 are considered premium devices. Apple does not offer any serious form of fast charging. Samsung should be differentiating there, especially with Type-C charging coming to the iPhone 15, because it could be yet another place for Samsung to create a superior experience.

Galaxy Tab S9 series

Samsung is offering three tiers of the Galaxy Tab S9 tablet with the S9, S9+ and S9 Ultra. All models ship with the Snapdragon 8 Gen 2 for Galaxy processor but come in wildly varying display, RAM, storage and camera configurations. The one nice thing that Samsung has included is support for microSD up to 1TB on all models. This makes the storage configurations less relevant, but may be a great feature for the entry-level Tab S9, which ships with only 128GB of storage and 8GB of RAM. Samsung also offers a Tab S9 with 12GB of RAM and 256GB of storage.

The S9+ starts with 12GB of RAM and 256GB of storage; it also comes in a slightly upgraded 512GB model, without any RAM bump. The Tab S9 Ultra offers the same RAM and storage configurations as the S9+, but with the option for an additional 16GB of RAM and 1TB of storage.

These tablets all come with varying display sizes: the S9 is an 11-inch device, while the S9+ has a 12.4-inch display and the S9 Ultra has a 14.6-inch display. All displays are 120-hertz Dynamic AMOLED 2X displays from Samsung. Oddly, Samsung doesn’t quote these display resolutions on its spec sheets, but I would be surprised if all of them come at the same resolutions, considering the huge differences in size.

However, the display sizes do affect the battery capacity; the Tab S9 starts at 8,400 mAh, the Tab S9+ at 10,090 mAh and the Tab S9 Ultra at 11,200 mAh. All four models ship with quad stereo speakers from AKG with Dolby Atmos. As far cameras go, the S9 features a single 13-megapixel main camera and a 12-megapixel front-facing camera, while the S9+ moves to a dual 13-megapixel and 8-megapixel configuration for the main camera while employing the same front-facing camera as the Tab S9. The Tab S9 Ultra borrows the same main camera as the S9+ while upgrading the front-facing setup to a dual-camera configuration with 12-megapixel cameras. Regarding connectivity, all of these models come with Wi-Fi 6E (no mention of Wi-Fi 7), BT 5.3 and 5G and LTE on select models. It appears that Samsung is looking to ship the Galaxy Tab S9+ as the primary 5G variant in the Galaxy Tab S9 family.

Samsung’s tablets have really been the only Android tablets competitive with Apple’s iPad and are my default recommendation for most people wanting to buy a competent Android tablet. It’s quite clear that Samsung is looking to capture three very distinct parts of the market with its different Tab offerings. It wants to keep the Tab series filling the Android tablet market with the latest processors and displays, even if it’s apparently not trying to change that market. Google may be trying to, and I hope that Google’s entry into the tablet and foldable market will lead to more competent software for Android tablets than what we’ve seen in the past, because what we’ve been getting has been pretty poor.

Watch6 and Watch6 Classic

Last but certainly not least is the Watch6 family, which is offered in the Watch6 and Watch6 Classic models. The Watch6 Classic returns to the much-loved rotating bezel that was sorely missed in the Watch5 Pro. The Watch6 Classic offers a larger display size while the Watch6 offers smaller display sizes and no rotating bezel. In sum, Samsung is offering four different variants: the Watch6 in 40mm and 44mm and the Watch6 Classic in 43mm and 47mm. Samsung is also much better at getting the most out of its bezel than Google with the Pixel Watch, which I have also reviewed.

One interesting note is that Samsung’s new watches uses Wear OS 4, which is Google’s latest wearable operating system built in partnership with Samsung. As with the Watch5, it appears that Samsung is likely to ship the Watch6 with Wear OS 4 before Google ships it on the Pixel Watch.

As far as battery capacity, Samsung has given the watches with smaller screens 300 mAh batteries and watches with larger screens 425 mAh batteries. These are considerably smaller than what Samsung offered (590 mAh) for the Watch5 Pro, but larger than what it offered for the base-model Watch5. However, Samsung is still quoting a 40-hour battery life with the always-on display turned off and 30 hours with it turned on, which is more than enough for most people.

Samsung is bumping up the resolution on the larger screen variants to 480 x 480, compared to 450 x 450 on the Watch5 Pro. Samsung will offer all models with a standard 2GB RAM and 16GB storage for onboard apps, as well as the new—nearly 20% faster—W930 processor. Samsung is also going to offer all models with an LTE option as well, but as someone who has used multiple generations of LTE-connected watches, I can tell you there is little reason to take the hit to battery life of a connected cellular watch unless you like to go on runs without your smartphone.

Wrapping up

In my opinion, Samsung helped to create and grow the foldable category and still owns the Android wearable and tablet markets. While I don’t think that Samsung has done anything earth-shattering in any of these categories with its newly announced products, it still maintains a leadership position in nearly every niche.

I think Samsung faces the biggest challenge to its position with the Flip5, where Motorola and others have created compelling products that are competitively priced and specced, even though Samsung still has the fastest processors and 5G capabilities in the market. I think that Samsung could have done a better job of defending its territory with the Flip5, but I do believe that with ample marketing, it could hold off Motorola. That said, I also believe Motorola could counter Samsung with equally aggressive marketing, which I already see a lot of. I also expect that we’ll see the usual trade-in offers for launch day from carriers including T-Mobile, AT&T and Verizon, which will likely offer the Flip5 for free with trade-in and the Fold5 with a heavy discount.

With the Fold5, Tab S9 and Watch6, I think Samsung continues to hold undisputed leadership positions. I am excited to see how incremental improvements across the board will keep Samsung atop the Android ecosystem.

Moor Insights & Strategy provides or has provided paid services to technology companies like all research and tech industry analyst firms. These services include research, analysis, advising, consulting, benchmarking, acquisition matchmaking, and video and speaking sponsorships. The company has had or currently has paid business relationships with 8×8, Accenture, A10 Networks, Advanced Micro Devices, Amazon, Amazon Web Services, Ambient Scientific, Ampere Computing, Anuta Networks, Applied Brain Research, Applied Micro, Apstra, Arm, Aruba Networks (now HPE), Atom Computing, AT&T, Aura, Automation Anywhere, AWS, A-10 Strategies, Bitfusion, Blaize, Box, Broadcom, C3.AI, Calix, Cadence Systems, Campfire, Cisco Systems, Clear Software, Cloudera, Clumio, Cohesity, Cognitive Systems, CompuCom, Cradlepoint, CyberArk, Dell, Dell EMC, Dell Technologies, Diablo Technologies, Dialogue Group, Digital Optics, Dreamium Labs, D-Wave, Echelon, Ericsson, Extreme Networks, Five9, Flex, Foundries.io, Foxconn, Frame (now VMware), Fujitsu, Gen Z Consortium, Glue Networks, GlobalFoundries, Revolve (now Google), Google Cloud, Graphcore, Groq, Hiregenics, Hotwire Global, HP Inc., Hewlett Packard Enterprise, Honeywell, Huawei Technologies, HYCU, IBM, Infinidat, Infoblox, Infosys, Inseego, IonQ, IonVR, Inseego, Infosys, Infiot, Intel, Interdigital, Jabil Circuit, Juniper Networks, Keysight, Konica Minolta, Lattice Semiconductor, Lenovo, Linux Foundation, Lightbits Labs, LogicMonitor, LoRa Alliance, Luminar, MapBox, Marvell Technology, Mavenir, Marseille Inc, Mayfair Equity, Meraki (Cisco), Merck KGaA, Mesophere, Micron Technology, Microsoft, MiTEL, Mojo Networks, MongoDB, Multefire Alliance, National Instruments, Neat, NetApp, Nightwatch, NOKIA, Nortek, Novumind, NVIDIA, Nutanix, Nuvia (now Qualcomm), NXP, onsemi, ONUG, OpenStack Foundation, Oracle, Palo Alto Networks, Panasas, Peraso, Pexip, Pixelworks, Plume Design, PlusAI, Poly (formerly Plantronics), Portworx, Pure Storage, Qualcomm, Quantinuum, Rackspace, Rambus, Rayvolt E-Bikes, Red Hat, Renesas, Residio, Samsung Electronics, Samsung Semi, SAP, SAS, Scale Computing, Schneider Electric, SiFive, Silver Peak (now Aruba-HPE), SkyWorks, SONY Optical Storage, Splunk, Springpath (now Cisco), Spirent, Splunk, Sprint (now T-Mobile), Stratus Technologies, Symantec, Synaptics, Syniverse, Synopsys, Tanium, Telesign,TE Connectivity, TensTorrent, Tobii Technology, Teradata,T-Mobile, Treasure Data, Twitter, Unity Technologies, UiPath, Verizon Communications, VAST Data, Ventana Micro Systems, Vidyo, VMware, Wave Computing, Wellsmith, Xilinx, Zayo, Zebra, Zededa, Zendesk, Zoho, Zoom, and Zscaler. Moor Insights & Strategy founder, CEO, and Chief Analyst Patrick Moorhead is an investor in dMY Technology Group Inc. VI, Fivestone Partners, Frore Systems, Groq, MemryX, Movandi, and Ventana Micro., MemryX, Movandi, and Ventana Micro.

Read the full article here