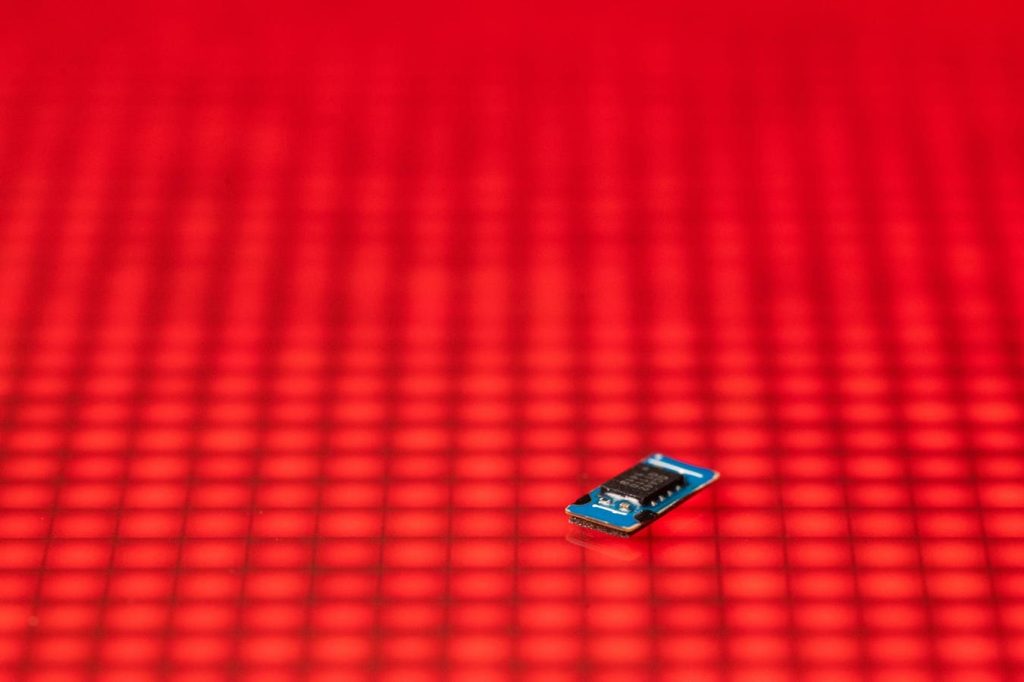

Fears are growing of another major chip shortage, following China’s decision to restrict the supply of key materials.

The tech industry has only just recovered from the last global chip shortage, which began during the Covid-19 pandemic in 2020 and ran right through to 2023. The shortage affected a wide range of goods, including computer processors, graphics cards, games consoles and cars.

Now there are concerns that shortages are about to resume, given the tight supply of materials such as gallium and germanium, which are used in the manufacture of semiconductors.

A report in The Financial Times claims that the cost of the two minerals has doubled in Europe over the past year, following Beijing’s decisions to limit their supply.

The Chinese government imposed the curbs in retaliation for the U.S.-led controls on sales of cutting-edge chips and semiconductor-making tools to China, over security fears.

Semiconductor Shortage

China has a stranglehold on the supply of the two minerals in question. The county produces 98% of the global supply of gallium, according to The Financial Times, and 60% of germanium.

The newspaper cites an unnamed source at a large consumer of semiconductor materials describing the situation as “critical.”

Consumer electronics aren’t the only devices that could be affected by constrained supplies of gallium and germanium. The two minerals are also used in the production of military equipment such as night-vision goggles.

The question now is whether the U.S. and other Western nations—including The Netherlands—will relax export controls to China to avoid another chip shortage.

The last shortage had a debilitating effect on several industries. Several car manufacturers were forced to halt or reduce production as they waited for chips to arrive. General Motors, Ford and Toyota were among the companies that were affected, resulting in far fewer new cars entering the market and a surge in the price of used cars.

Meanwhile, shortages of graphics cards sent prices of the components sky high during 2021, exacerbated by demand for graphic chips in cryptomining. Some graphics cards were being sold for more than four times their list price, as so-called scalping bots hoovered up supplies as soon as they became available online.

Any further constraints on chip supply could be highly damaging for companies such as semiconductor giant Intel, who are still recovering from the previous episode. Intel’s share price fell by almost 30% earlier this month when the company announced it was laying off 15,000 staff after recording a $1.6 billion loss in the second quarter.

Read the full article here