Intel stock is up 35% in the last three weeks on a string of good news. Is there more to come?

Semiconductors have been one of the fastest growing segments on Wall Street this year. Intel has quietly recovered its losses over the last year, with the bulk of the stock’s recovery just over the last three weeks. While still far short of NVIDIA and AMD’s meteoric rise on AI excitement, something appears to be happening in the company that is reshaping it’s prospects.

Let’s take a brief look into the recent news that has driven the stock’s sudden rise, and explore whether more good news might lie ahead for the company.

Intel’s New Chip to Advance Silicon Spin Qubit Research for Quantum Computing

As you know, Quantum Computing is coming! My recent piece on IBM’s accomplishments reached over 31,000 readers, so there is obviously considerable interest as this technology approaches useful results. Intel is no stranger to Quantum either, and just announced “Tunnel Falls”. Intel’s most advanced silicon spin qubit chip to date. “The release of the new chip is the next step in Intel’s long-term strategy to build a full-stack commercial quantum computing system,” said an Intel release.

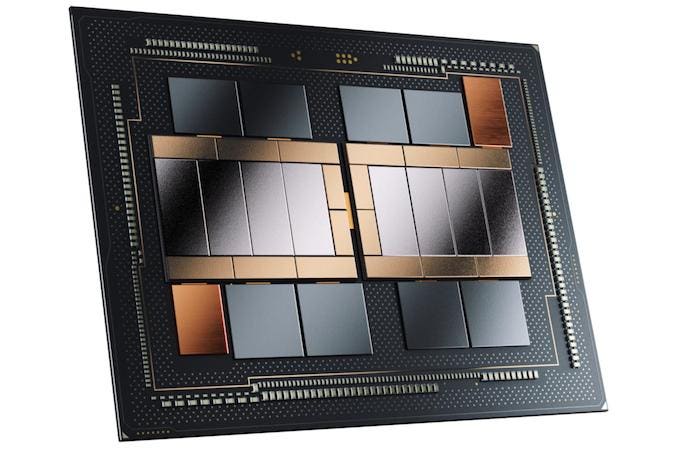

Intel Xeon Benchmarks Refute AMD’s Performance Claims

Intel has embedded its Advanced Matrix Extensions (AMX) into every core on Intel Xeon Sapphire Rapids CPUs. I have been awaiting the benchmarks for some time, and it appears that the company was holding on to these, releasing them just ahead of AMD’s data center event this week. The benchmarks and tests demonstrated that Intel’s processors outperform AMD Genoa in workloads that can benefit from the matrix engine, like AI, data analytics, high-performance computing (HPC), and other math-centric applications

From my perspective, these benchmarks look great and I would hope to see more results when MLCommons MLPerf Inference results are updated in about three months. But these results should cause customers considering defection to AMD Genoa some reason to pause and investigate further.

Intel AI Roadmap Changes

Intel announced some significant changes to its roadmap, especially in the AI arena. First, the company had planned on a combined GPU/CPU product, akin to what AMD has announced with the MI300A. But many AI workloads needs a lot more GPU than CPU, so the fixed CPU-GPU ratio of Ponte Vecchio isn’t well suited for the Large Language Models that are now the rage and power apps like ChatGPT. So, Intel has wisely redefined the follow-on 2nd-gen Max GPU to be a GPU-only design, code named Rialto Bridge. This is similar to the recently pre-announced AMD MI300X. Intel did not provide performance specs.

The second roadmap announcement was also a good move, wherein Intel said it will fold the AI processors of Habana Labs Gaudi accelerator into a future generation of their data center GPU. Looks like Intel has finally decided what it should do with Habana Labs; pick out the good parts for re-use, and shut the rest down. The company did say that Gaudi3 remains on track for 2024 production, so they may be seeing some market demand; a bit surprising given the lack of traction Gaudi2 has shown, in spite of good benchmark results.

Intel Plans Semiconductor Plant in Poland

Intel said it plans to invest up to $4.6 billion to build a semiconductor assembly and test facility in Poland, with the plant helping “meet demand for assembly and test capacity anticipated in coming years.” In a press release, the chip maker said the plant would create about 2,000 Intel jobs

US patent tribunal sides with Intel again in $2.2 billion VLSI case

According to Reuters, “A U.S. Patent Office tribunal ruled for Intel Corp (INTC.O) on Tuesday on the chipmaking giant’s bid to invalidate a patent that represented $1.5 billion of a $2.18 billion verdict it lost to VLSI Technology LLC in 2021. The Patent Trial and Appeal Board invalidated the computer chip-related patent after canceling another VLSI patent that accounted for the remainder of the Texas federal court verdict last month.” You can do a lot of engineering and market development with $1.5B.

Intel in Talks to Lead Arm IPO

Since Intel’s strategy is increasingly centered on regaining manufacturing parity with TSMC, investors were heartened by reports that Intel would be a lead investor in taking Arm public.

Intel Receives Stamp of Approval From Nvidia CEO

In an apparent node to Intel’s recovering manufacturing prowess, NVIDIA CEO Jensen Huang said, “We recently received the test chip results of their next-generation process, and the results look good.” While not a commitment to use Intel as a foundry, its better news than some expected.

Intel: Q2 revenue will come in at the high end of range

Intel rose 4% on May 31 as the company said it expected revenue to be at the upper end of its range at a TD Cowen conference. Intel sees 2Q revenue at the upper half and its likely tracking $12 billion to $12.5 billion, CFO David Zinsner said at TD Cowen Technology, Media and Telecom conference.

Analysts see material upside for Intel with AI

On Friday, Morgan Stanley analyst Joseph Moore had increased his target price on Intel to $38 from $31, while maintaining his equal weight rating on the stock. “Intel does have material AI opportunity, but due to larger legacy server business also has more meaningful headwinds as cloud budgets adjust to higher levels of AI spending,” Moore said. “We see the principal near-term opportunities from Habana Labs/Gaudi, specialty silicon that the company acquired a couple of years ago, that could drive material revenue in inference next year (and training down the road).” I have a call into Intel to learn more about the Gaudi upside mentioned by this analyst.

Conclusions

We certainly are impressed with the string of good news coming from Santa Clara of late, and hope for the sake of US semiconductor competitiveness that this is a new trend. We were especially pleased to see the new benchmarks on Xeon AI; while Intel continues to invest in dedicated accelerators, Intel CPUs are still the workhorse of most AI today. And we were happy to see the roadmap changes, which better meet the needs of AI customers and should help Intel solidify its AI software stack.

I plan to attend the Intel Innovation event, coming September 19-20 in San Jose, a revived IDF which never should have been shelved in the first place. I expect to see a lot more progress between now and then to reaffirm that a bottom has been put in for Intel.

Hope to see you there!

Disclosures: This article expresses the opinions of the author(s), and is not to be taken as advice to purchase from nor invest in the companies mentioned. Cambrian AI Research is fortunate to have many, if not most, semiconductor firms as our clients, including Blaize, Cadence Design, Cerebras, D-Matrix, Eliyan, Esperanto, FuriosaAI, Graphcore, GML, IBM, Intel, Mythic, NVIDIA, Qualcomm Technologies, Si-Five, SiMa.ai, Synopsys, and Tenstorrent. We have no investment positions in any of the companies mentioned in this article and do not plan to initiate any in the near future. For more information, please visit our website at https://cambrian-AI.com.

Read the full article here