- Stripe and Authorize.net are two of the best credit card processing providers that can support small businesses.

- Stripe and Authorize.net have somewhat different pricing plans and features, and knowing which one is best suited for your business is key to a successful relationship.

- This comparison page breaks down the similarities and differences between Stripe and Authorize.net, including pricing, features, and how to choose the best credit card processor for your business.

- This article is for business owners considering Stripe and Authorize.net as their credit card processing service provider.

If you run an e-commerce business, the ability to accept online payments is crucial. And it’s important to be able to accept a wide variety of customer payments, like credit and debit cards, electronic wallets, and prepaid cards.

A payment processor collects financial data from the customer, verifies that information with the bank or payment provider, and processes the transaction. A full payment processing system needs a payment processor, a payment gateway and a merchant account.

Some payment processing services offer one or all of these elements. For example, Stripe offers an all-in-one solution, while competitor Authorize.net only offers a payment gateway. This article will include a full breakdown of Stripe vs. Authorize.net to help you decide which online payment processor is best for your business.

Stripe vs. Authorize.net

| Similarities | Differences |

|---|---|

| Both offer payment gateways. | Stripe offers additional payment services. |

| They are easy to integrate. | Authorize.net charges a setup fee. |

| They can process the same payment methods or credit cards. | Stripe is better for third-party integrations. |

| Both are very secure options. | Stripe requires more development or coding experience. |

The main difference between Stripe and Authorize.net comes down to the service the companies offer. Stripe is a full-fledged payment service provider, which means it comes with everything you need to accept and process online payments. Stripe includes a payment gateway, payment processing service and merchant account.

In contrast, Authorize.net solely offers a payment gateway. Though its service offerings are a bit more limited, Authorize.net is easier to understand and integrate from start to finish.

Both services have a wide range of features and are suitable for different business types. For instance, Stripe is the better option if you don’t already have some kind of payment-related service setup. It’s also a better choice if you’re looking to get your e-commerce business up and running immediately. Authorize.net may be a better option if you have an existing merchant account and simply need a payment gateway to accept online payments.

Here’s a more detailed comparison of the platforms and what they offer.

Similarities between Stripe and Authorize.net

These are some key similarities of the two services:

- Both companies offer high-quality payment gateway services.

- Both are reasonably easy to integrate with your e-commerce platform, though Authorize.net is a little more hands-off.

- Both Authorize.net and Stripe can process credit cards, debit cards, foreign cards, foreign currencies, and digital wallets like PayPal and Apple Pay.

- Both Stripe and Authorize.net will process secure transactions and keep your customers’ data safe.

Differences between Stripe and Authorize.net

These are some significant differences between the two companies:

- Stripe doesn’t require you to have a merchant account already because it offers merchant account services. Authorize.net requires you to have a separate merchant account.

- Authorize.net charges a one-time setup fee.

- Stripe has many more third-party integrations.

- Stripe requires a little more development experience to make full use of its features.

Stripe: Who do we recommend it for?

Stripe is an all-in-one payment processing service that includes a merchant account, payment gateway and payment processor. The fees are low, and if you run a brick-and-mortar business, you can receive an additional POS system and card reader.

Designed with third-party integration in mind from the get-go, Stripe is an ideal choice for online businesses that accept various mobile or online transactions. It’s also fairly customizable, thanks to its modifiable API and toolkit.

Ultimately, Stripe is a great choice for tech companies or more developed online enterprises that want flexible payment solutions. Here are some of the main benefits of using Stripe:

- It accepts mobile payments.

- It includes options for POS and card readers.

- It contains a payment processor, payment gateway and merchant account in a single service.

- You can use its API for in-app purchases.

- You can customize various aspects of your POS or checkout system.

Authorize.net: Who do we recommend it for?

Authorize.net is a much simpler payment gateway service, and its service offerings are more limited than what Stripe provides. But it’s a great option if you’re looking for something to integrate with your existing e-commerce platform.

Authorize.net includes excellent fraud detection tools, recurring billing and a streamlined checkout process. If you need a merchant account or payment processing service, the company can connect you to one of its partnered providers.

Consequently, Authorize.net is a good choice for if you already have a merchant account and aren’t looking to switch. Here are the main benefits of using Authorize.net:

- It provides an exceptional payment gateway service.

- It includes a variety of payment control tools, such as automatic recurring billing and customer information management.

- It can recommend its partnered merchant accounts and payment processing service providers.

- It delivers the funds to your business bank account quickly.

Learn more about the differences between a payment processor and a payment gateway.

Criteria comparisons of Stripe and Authorize.net

| Category | Winner |

|---|---|

| Plans | Tie |

| Pricing | Stripe |

| Features | Stripe |

| Ease of use | Authorize.net |

| Integrations | Stripe |

| Support | Stripe |

| Employee self-service | Stripe |

| Additional services | Tie |

Still on the fence about which service is best for your business? Let’s go into more detail about these comparisons.

Plans

- Stripe: Stripe only offers two plans – Integrated and Customized. Integrated is the standard choice for most companies because it includes everything you need to begin accepting online payments. There are no monthly or hidden fees, and you’ll receive hundreds of feature updates each year. The Customized plan is better for enterprise companies that need custom payment options.

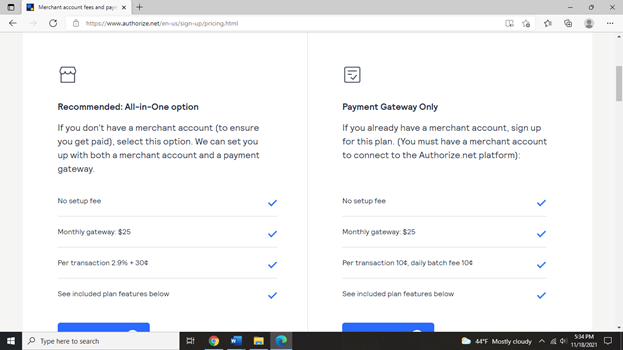

- Authorize.net: Authorize.net also offers two plans, and both have a monthly fee of $25. The All-in-One plan sets you up with the payment gateway, a merchant account and payment processing service from one of its partnered companies. The Payment Gateway Only plan, as the name indicates, just includes the payment gateway.

- Winner: Tie – it really depends on what you need out of a payment service provider.

Pricing

- Stripe: Stripe’s pricing depends on which payment plan you choose. The Integrated plan allows you to pay as you go and charges a 2.9% fee plus 30 cents for every transaction. The Customized plan gives you custom pricing options. Stripe also offers a $59 card reader and a POS terminal for $249.

Source: Stripe.com

- Authorize.net: Authorize.net also has two payment options, both with a $25 monthly fee. The All-in-One plan is for businesses that don’t already have a merchant account. You’ll pay a fee of 2.9% plus 30 cents per successful credit card transaction, which is the same as what Stripe charges. The Payment Gateway Only plan has a fee of 10 cents per transaction and a daily fee of 10 cents.

- Winner: Stripe. The two payment services charge similar fees, but Stripe gives the option for additional products. And unlike Authorize.net, Stripe doesn’t charge monthly fees.

Source: Authorize.net

Features

- Stripe: Stripe comes with a payment gateway, merchant account and payment processing abilities. You can start accepting customer payments immediately, and Stripe accepts most payment types. Plus, the company offers tools – like a custom UI toolkit and API. You can also take advantage of Stripe Connect, which allows you to customize various aspects of your marketplace and checkout process.

- Authorize.net: Authorize.net only includes a payment gateway, but the company can connect you to one of its partners if you need a merchant account or payment processor. Aside from its basic payment gateway service, Authorize.net offers a simple checkout solution, invoicing controls and automated recurring billing.

- Winner: Stripe, because it’s an all-in-one solution with more features and tools than Authorize.net.

Ease of use

- Stripe: Stripe’s user interface and dashboard are both well designed. However, if you want to maximize this payment service provider’s toolkit, it’s best if you are comfortable using the developer API and in-depth controls.

- Authorize.net: Authorize.net is much easier to use and set up. The service easily integrates with your existing merchant account or payment processing service. Additionally, if you want to be set up with one of its partnered payment processors for merchant accounts, the company can walk you through the process.

- Winner: Authorize.net, as Stripe’s wider range of tools and customizations has a steeper learning curve.

Integrations

- Stripe: Stripe has over 300 possible integrations, including Zoho CRM, Xero, ShipStation and Commerce Sync.

- Authorize.net: Authorize.net makes integrations easy through Simple Checkout, which lets you integrate your marketplace with third-party tools. It can also integrate with Commerce Sync.

- Winner: Stripe. Both solutions have third-party integrations, but Stripe’s options are more extensive than Authorize.net’s.

Support

- Stripe: Stripe provides customer support through three major channels – email, live chat and phone. You can take advantage of 24/7 support, and the live chat response usually only takes a couple of minutes. You’ll also benefit from an extensive knowledge base if you need help tinkering with Stripe’s code.

- Authorize.net: Authorize.net offers a 24/7 support center, which you can contact online or by phone. You can also open a support ticket if you have a more complex question or if a customer service representative isn’t immediately available to help you.

- Winner: Stripe, thanks to its in-depth knowledge base with how-to articles and programming support.

Employee self-service

- Stripe: Stripe is a much more hands-on option than Authorize.net. That’s because it includes a full kit of developer tools that you can use to add functions or features to your payment processing system at any time. You can change your payment page and mobile checkout experience to better meet your customers’ needs. You can also use the third-party integrations for employee self-service tools – like clocking in and out, or checking inventory.

- Authorize.net: Authorize.net is not nearly as customizable as Stripe, and it doesn’t come with the same spread of employee tools. But it does have a full customer information manager (CIM) suite, where you can store customer information and pull it up at any time. This could be helpful for employees at your brick-and-mortar store or allow you to access sensitive information online.

- Winner: Stripe, but only if you take the time to fully develop and customize the payment processing service.

Additional services

- Stripe: Stripe offers a wide array of services beyond its payment processing features. For instance, Stripe Sigma is an advanced reporting system you can access from the main dashboard. There’s also Radar, a fraud monitoring tool that allows you or other merchants to review and override transactions. Stripe also makes it easy to display currencies and conversions in multiple formats, and it automatically updates credit card data in your customer vault to ensure that subscriptions are current.

- Authorize.net: Authorize.net offers a handful of services beyond its basic payment gateway. That includes a CIM, e-check processing, QuickBooks integration and advanced fraud detection. The advanced fraud detection suite is included for free with your account and comes with 13 filters you can customize to block fraudulent transactions.

- Winner: Tie, because both services offer a wide range of tools.

Stripe vs. Authorize.net recap

Both Stripe and Authorize.net are worthy choices to accept online payments for your e-commerce business. However, these services are designed for different types of companies.

It’s best to use Stripe if you fall under these requirements:

- You need an all-in-one solution with a merchant account, payment processor and payment gateway.

- You want your payment processing service to be customizable.

- You need low fees.

- You want a card reader or POS terminal.

Go with Authorize.net if you meet these criteria:

- You already have a merchant account and just need a payment gateway.

- You want an easy way to start accepting customer payments immediately.

- You need advanced security and anti-fraud features.

- You need fast transactions.

Looking for more comparisons to help you choose the right payment processing partner for your business? Read our comparison of Stripe and PayPal.

FAQs

Is Authorize.net like Stripe?

Authorize.net is like Stripe in that both of these services offer payment gateway solutions for e-commerce business owners. They also include tools like security and billing features. Plus, both of these services are easy to integrate with third-party business solutions.

Is Stripe the best payment gateway?

Stripe isn’t the best payment gateway for everyone. It is a great payment gateway for online companies or for businesses that accept various types of mobile payments.

Can I use Authorize.net with Squarespace?

No, you can’t use Authorize.net with Squarespace, because Squarespace doesn’t allow anyone access to its back-end code. So, third-party payment gateways – like Authorize.net – can’t be connected to this platform.

Is Authorize.net worth it?

Yes, Authorize.net is worth it if you already have a merchant account and want a relatively affordable, easy-to-use payment gateway service.

Read the full article here