- Stripe is a far more robust financial services provider and charges lower fees.

- Stripe is customizable, and allows your business to accept different payment options.

- PayPal has simple and straightforward invoicing tools for your service-based company. Read our guide on how to send invoices with PayPal to learn more about these tools.

- This article is for small business owners interested in online payment processing options.

Stripe and PayPal are credit card processing providers that process your customers’ payments. Stripe is primarily a merchant services provider that allows you to customize its solutions for online or brick-and-mortar sales. PayPal is mainly a digital wallet.

If your business engages in a high volume of sales – either in person or online – and you want the ability to accept many forms of payment, then Stripe is the better option. However, PayPal may be a better choice if you already use the platform to send invoices and receive payments for your small business.

Stripe may benefit your business by accepting multiple payment forms for your high volume of sales, while PayPal may better suit your company if you already use the platform.

Stripe vs. PayPal at a glance

| Stripe | Paypal | |

|---|---|---|

| Best for | High-volume e-commerce business with web development resources |

Small business with low sales volume Consultants and companies that invoice clients |

| Online transaction costs | 2.9% + $0.30 per transaction | 3.49% + $0.49 per transaction |

| Payment methods | Credit and debit cards, ACH payments, Google Pay, Apple Pay, Microsoft Pay, various foreign payment methods | Credit and debit cards, ACH payments, Pay in 4, Venmo, Google Pay |

| E-commerce payment processing | Yes | Yes |

| Point-of-sale systems | Yes | Yes |

| Billing and invoicing | Yes | Yes |

| Business financing | Merchant cash advances |

Business loans Business lines of credit |

What is Stripe?

Stripe is a financial services company that functions primarily as a merchant services provider. The company sells a leading point-of-sale (POS) system and has plugins for e-commerce tools that equip your business to receive payments from customers.

As a payment processing company, Stripe can aid your business to accept payments through many different methods – for a fee. Payments are then deposited into a merchant account, which Stripe supplies, and are automatically transferred into your business checking account as soon as the next day.

How Stripe works

When you sign up with Stripe, you can choose from its standard offerings or a customized e-commerce package. You’ll have the option to purchase equipment or download plugins to process payments, and use a personal dashboard to help track the payments you receive.

In addition to payment processing for your online business, you’ll also gain access to Stripe’s other services, including billing, invoicing and identity protection. Depending on which service you choose, you can utilize inventory-management tools or integrate Stripe directly with QuickBooks.

Here’s an example of a Stripe dashboard:

Source: Stripe

Additional Stripe services

In addition to payment processing, Stripe offers these services:

- Business billing: Create recurring invoices and subscriptions – the fee is 0.5% on recurring charges.

- Invoicing: Invoice up to 25 customers each month for free – pay 0.4% per paid invoice after that.

- Card issuing: Offer your clients rewards and promotions using custom gift cards.

- Tax calculation tools: Take advantage of the platform’s tax calculation tools – the cost is 0.5% per transaction.

- Identity protection services: Utilize identification tools to verify your customers’ identities – the fee is $1.50 per verification.

- Fraud protection: Protect against fraud and prevents chargebacks with Stripe’s Radar service.

- Inventory management: Track items that you carry on hand, and set up alerts to let you know when to order more.

Stripe costs

If you choose Stripe for processing your brick-and-mortar or e-commerce payments, expect to pay fees starting at 5 cents per transaction plus 2.7% of the transaction value – 30 cents per transaction plus 2.9% for e-commerce. Pricing is the same for all cards and digital wallets, including Visa, Mastercard, Maestro, American Express, Discover, JCB, Apple Pay and Google Pay. Integrations are also available for other global payment methods, such as Giropay.

If your company has a unique business model – including large payment volume, country-specific rates, multi-product discounts or other specific features – Stripe will work with you to create a custom payment processing plan that can lower processing fees.

When to use Stripe

Stripe excels because it offers your business competitive pricing and a wide selection of tools. Consider using Stripe if you meet any of these criteria:

- Your online business relies heavily on e-commerce.

- You desire a completely customizable platform.

- Your organization routinely engages in online sales.

- You need enhanced fraud-prevention tools.

One big drawback of Stripe is that, with so many tools and features available, you may need some development experience to set it up. If you don’t know an IT specialist and don’t have the means to pay someone to help you configure Stripe, you may want to use PayPal or find a simpler system, because the software’s bells and whistles can be overwhelming.

What is PayPal?

Like Stripe, PayPal is a financial services company. However, PayPal functions primarily as a digital wallet for individuals or your small business. It’s generally used for sending money to friends and family, invoicing clients and receiving payments.

While Stripe focuses heavily on processing credit card payments for merchants, PayPal focuses on invoicing clients and receiving payments for work performed. PayPal also offers merchant services like POS systems and credit card processing, but its merchant services are much narrower and more expensive than Stripe providers.

How PayPal works

To get started with PayPal, sign up on the PayPal website. Registration is straightforward, and instantly grants new users access to a digital wallet for sending and receiving funds. You can also link bank accounts to transfer money on and off the platform.

Once you’re signed up for PayPal, you can decide how best to use the platform to support your needs, order equipment, or add tools and features. You can also order a POS system, acquire a business loan, or use the platform to send individual invoices and receive payments.

Additional PayPal services

In addition to payment processing, PayPal offers these services:

- Invoicing: PayPal’s invoicing tool is easy to use. There’s no fee for sending an invoice, but the company collects a fee from merchants for all invoices paid through the platform.

- Business loans: Business account customers can apply for a PayPal Business Loan to help cover expenses. Prospective borrowers use PayPal’s online tool to check their eligibility – without impacting their credit score. Eligibility is based on several factors, including your credit history and your company’s overall financial health.

- Working capital: PayPal also offers flexible lines of credit if your business regularly needs access to small amounts of capital to cover expenses.

- Seller protection: Seller protection guards you against fraud and reduces the risk of chargebacks.

- Tax calculation tools: These tools help you calculate sales taxes owed on transactions based on location and transaction type.

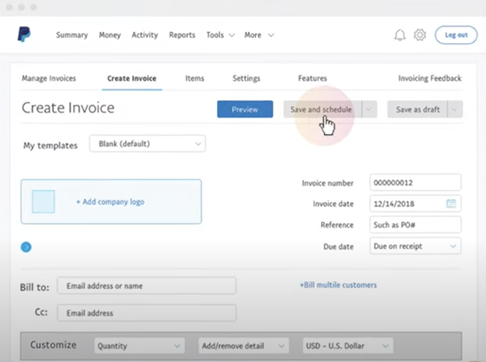

Here’s a sample of how easy it is to create an invoice using the PayPal platform:

Source: PayPal

PayPal costs

PayPal transaction fees are based on the type of payment being processed, and whether transactions are domestic or international. Rates vary from 1.9% – plus a fixed fee for QR code transactions valued over $10 – to 3.49% with an additional fixed fee for standard PayPal checkout, invoicing, Venmo and other commercial transactions. American Express payments made via PayPal guest checkout include a 3.5% fee, but there is no additional fixed fee.

When to use PayPal

PayPal is considerably more expensive than other payment processing companies. Your service-based company, such as a consultant or landscaper, is an ideal user because you require a simple tool to quickly send invoices.

If you seek a tool that also receives payments, and you’re not inclined to set up a more complex system like Stripe, then PayPal may be your solution.

These are some typical scenarios for using PayPal:

- You already use PayPal personally to send and receive payments with friends and family.

- You are looking to accept PayPal transactions.

- You have a low volume of sales and are willing to pay higher fees for simplicity.

- Your multichannel business engages in both online and brick-and-mortar sales.

Learn about PayPal Here and PayPal Zettle, which are PayPal’s credit card reader and app solutions. Consider our full list of PayPal alternatives if you’re looking into other options.

Stripe pros and cons

When you’re considering Stripe as a payment processing tool for your business, evaluate its upsides and drawbacks.

Stripe pros

- Low pricing: Stripe is considerably less expensive than PayPal for every transaction type.

- Full integration: The platform offers many options, including POS systems and merchant accounts.

- No setup, cancellation or account maintenance fees: Stripe offers an inexpensive trial and is cost-effective for seasonal businesses.

- Extensive customization: There are tools, features and plugins for various companies.

- Quick account signup: It is easy to get set up online with Stripe; however, it can take a little while if you need to have equipment shipped to you.

Stripe cons

- Suspended user accounts: If you process a bad transaction or have a technical issue, you may need to resolve the issue before accepting future payments.

- Chargeback fees: If you process a fraudulent transaction, you may have to refund the transaction and incur up to a $15 fee.

- Mandatory credit card readers: You’ll need to pay for an in-person card reader, while PayPal will give you a free card reader. (PayPal also has paid card readers.)

- Complex setup: If you do not have IT personnel or a friend to assist you with customizing Stripe, you may have difficulty setting up extra features.

- Limited tax services: You may need to calculate taxes yourself or hire a CPA.

PayPal pros and cons

PayPal pros

- Easy setup: PayPal can be used straight out of the box; you don’t need any development experience or outside resources to set it up.

- Optional merchant account: PayPal is a digital wallet to hold funds, and you can link bank accounts to transfer money.

- Simplified invoicing: PayPal’s invoicing tool is straightforward and easy to use.

- Streamlined payments: It’s easy to set up automatic recurring payments, even in different currencies.

- Easy integration: PayPal integrates with various popular e-commerce platforms, including WooCommerce, Shopify, Wix, Depop and Squarespace.

PayPal cons

- High expense: PayPal increased its processing fees for U.S. merchants in August 2021, and is now more expensive than Stripe and other top payment processing options. Considering an alternative to PayPal? See our review of Square.

- Chargeback fees: If you process a fraudulent transaction and a cardholder disputes the transaction, you’ll be charged a $20 fee – unless the transaction is covered by PayPal’s seller protection program.

- Suspended user accounts: If you process too many fraudulent transactions or fail to pay fees, you may not be able to process payments.

- Limited personalization: PayPal is simpler to set up, but it can’t be customized to fit your specific needs.

- Shoppers’ preferences: Some individuals don’t like using PayPal to send money, or they may think the platform lacks security.

- Limited payment methods: Your company can use PayPal to accept PayPal Cash or PayPal Cash Plus account balances, bank accounts, PayPal Credit, debit or credit cards, and rewards balances. However, the platform can’t accept some major methods, such as Apple Pay.

Read the full article here