Oracle has announced the latest in what it calls its database machine family—the Exadata X10M. Specifically engineered at the source code level for Oracle database environments, this Exadata generation is the first to be based on AMD’s EPYC server processors. What is the significance of this platform? And what does it mean for database performance? I’ll break that down in the following sections.

Exadata 101

Before getting into Oracle’s announcement, it’s worth spending a paragraph or two setting the context on Exadata. Oracle’s Exadata platform incorporates hardware and software co-engineered with Oracle database and optimized to support enterprise data management. If you’re an enterprise IT professional looking to deploy and maintain a database environment to support traditional online transaction processing (OLTP) workloads along with analytics, you understand the struggle involved. Finding the perfectly tuned server and maintaining that environment can seem impossible. And this doesn’t even account for the new database types populating the enterprise—graph, spatial, JSON.

This is where Exadata enters the equation. Oracle has channeled its decades of experience in deploying data management platforms in the largest enterprises to design the killer database server, or what it calls a database machine. In doing so, it created a complete, full stack system with the lowest latency and fastest processors, memory and storage. Even better, it complemented this hardware with system software that manages how data is stored, indexed and moved. If you ever wondered why Oracle would have a Linux distribution—this is it. The company has tweaked and optimized every lever to deliver a database machine that is unmatched in performance.

ADVERTISEMENT

Looking under the covers of Exadata X10M, a data-tuned hardware platform

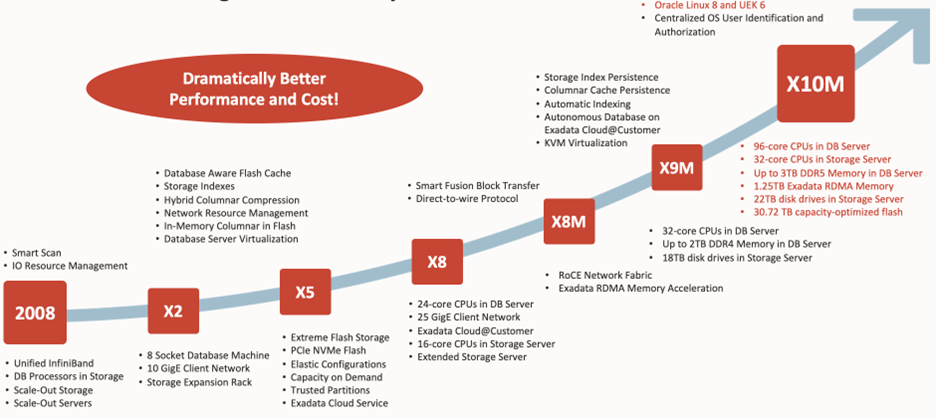

Understanding how much time and effort Oracle put into Exadata, it only makes sense that the company would take advantage of the server components that can deliver the greatest performance (and value) for its database environments. You can see in the graph below how the company has continued to deliver value, generation after generation.

With the Exadata X10M, the innovation continues. The story of X10M starts with the processor level, where Oracle designed its platform around AMD’s 4th Generation EPYC CPU. This design decision has many direct benefits beyond merely having more (and better-performing) cores. Accompanying 96 multithreaded cores in the database server is up to 3TB of DDR5 memory across 12 memory channels, significant cache and PCIe5 I/O to deliver system-level performance boosts.

ADVERTISEMENT

The Exadata database server is connected to storage via an RDMA over Converged Ethernet (RoCE) switch. This is a high-speed (100Gbps) connection that delivers the lowest latencies and highest bandwidth as it bypasses operating system and network stacks.

Based on what I just described, you can see that the Exadata X10M is not simply about using EPYC as the CPU. Beyond the hardware, Oracle has optimized its entire software stack to enable linear scale in performance across so many additional cores. Further, the company optimized its RDMA and in-memory columnar algorithms to take full advantage of AMD’s memory management and AVX instruction set. I call these out specifically to demonstrate the ability of the Oracle engineering team to squeeze every bit of performance out of EPYC’s 96 cores and 3TB of memory.

Oracle’s optimizations don’t apply only to getting the most out of EPYC, either. The company recently released a number of other optimizations to improve Exadata in terms of performance, security and ease of management.

ADVERTISEMENT

How this design translates into extreme performance

Numbers don’t lie. In the case of Exadata X10M, the numbers are extreme. Oracle’s value prop for Exadata focuses on OLTP performance, analytics and database consolidation. And the value customers gain across three focus areas result from the combined engineering between Oracle and AMD. (Note that these performance claims are in comparison to the previous Exadata generation, the X9M).

ADVERTISEMENT

What I like about the data Oracle has published is that it highlights something I mentioned earlier: the enhanced results that have arisen from Oracle working with AMD to deliver the best possible performance. This is about more than just more cores, memory or cache. If it were only that, these numbers wouldn’t have scaled as much as shown.

Oracle claims the Exadata X10M is far more performant at a lower cost than its competitors. I understand its claims. It is the only company with decades of experience delivering both enterprise database software and database hardware solutions. This level of ability for building a tailored data management platform is probably unique to Oracle.

On-prem or in the cloud

How do customers consume Exadata? It’s up to them. On-prem, in the cloud, on-prem as a cloud service—it doesn’t matter. Heck, customers can even run this in a multi-cloud deployment.

ADVERTISEMENT

I especially like the work of Oracle Cloud Infrastructure to coordinate with Microsoft Azure in building a dedicated, high-speed interconnect. This allows customers to have their apps in Azure while data sits in the Exadata Database Service or Autonomous Database on OCI. Performance is incredible, and it comes without the high ingress/egress fees associated with other multi-cloud deployments.

Final thoughts

Oracle continues to drive innovation around its core cloud database products. During the years that I was an IT executive, I was constantly faced with having to do more, faster, with less budget. That was in the early days of business process automation and the digitization of services, but this set of challenges has not gone away since I left IT. In fact, it’s bigger than ever. Demands grow and It budgets are squeezed even more.

ADVERTISEMENT

Exadata seems like an obvious choice for those IT organizations that face the pressures to do a lot more with a lot less. Up to 3x the transaction throughput and up to 3.6x the analytics performance at no price increase? Exadata X10M is a business agility grand slam and a TCO no-brainer.

I’ve said this before: this is a new Oracle. The company appears to be maniacally focused on delivering products and services to customers on the customer’s terms and in a far more affordable way than in the past. For Exadata X10M, this means extreme scale, performance and value. The company is clearly in growth mode with its cloud and database services and has learned a few things from its past—and from watching competitors and partners make this transition.

As usual, I’ll check back in a few quarters to see how X10M lands in the market. I expect strong adoption given some of the largest financial, telecom, and retail businesses run on Exadata.

Game on.

ADVERTISEMENT

Moor Insights & Strategy provides or has provided paid services to technology companies like all research and tech industry analyst firms. These services include research, analysis, advising, consulting, benchmarking, acquisition matchmaking, and video and speaking sponsorships. The company has had or currently has paid business relationships with 8×8, Accenture, A10 Networks, Advanced Micro Devices, Amazon, Amazon Web Services, Ambient Scientific, Ampere Computing, Anuta Networks, Applied Brain Research, Applied Micro, Apstra, Arm, Aruba Networks (now HPE), Atom Computing, AT&T, Aura, Automation Anywhere, AWS, A-10 Strategies, Bitfusion, Blaize, Box, Broadcom, C3.AI, Calix, Cadence Systems, Campfire, Cisco Systems, Clear Software, Cloudera, Clumio, Cohesity, Cognitive Systems, CompuCom, Cradlepoint, CyberArk, Dell, Dell EMC, Dell Technologies, Diablo Technologies, Dialogue Group, Digital Optics, Dreamium Labs, D-Wave, Echelon, Ericsson, Extreme Networks, Five9, Flex, Foundries.io, Foxconn, Frame (now VMware), Fujitsu, Gen Z Consortium, Glue Networks, GlobalFoundries, Revolve (now Google), Google Cloud, Graphcore, Groq, Hiregenics, Hotwire Global, HP Inc., Hewlett Packard Enterprise, Honeywell, Huawei Technologies, HYCU, IBM, Infinidat, Infoblox, Infosys, Inseego, IonQ, IonVR, Inseego, Infosys, Infiot, Intel, Interdigital, Jabil Circuit, Juniper Networks, Keysight, Konica Minolta, Lattice Semiconductor, Lenovo, Linux Foundation, Lightbits Labs, LogicMonitor, LoRa Alliance, Luminar, MapBox, Marvell Technology, Mavenir, Marseille Inc, Mayfair Equity, Meraki (Cisco), Merck KGaA, Mesophere, Micron Technology, Microsoft, MiTEL, Mojo Networks, MongoDB, Multefire Alliance, National Instruments, Neat, NetApp, Nightwatch, NOKIA, Nortek, Novumind, NVIDIA, Nutanix, Nuvia (now Qualcomm), NXP, onsemi, ONUG, OpenStack Foundation, Oracle, Palo Alto Networks, Panasas, Peraso, Pexip, Pixelworks, Plume Design, PlusAI, Poly (formerly Plantronics), Portworx, Pure Storage, Qualcomm, Quantinuum, Rackspace, Rambus, Rayvolt E-Bikes, Red Hat, Renesas, Residio, Samsung Electronics, Samsung Semi, SAP, SAS, Scale Computing, Schneider Electric, SiFive, Silver Peak (now Aruba-HPE), SkyWorks, SONY Optical Storage, Splunk, Springpath (now Cisco), Spirent, Splunk, Sprint (now T-Mobile), Stratus Technologies, Symantec, Synaptics, Syniverse, Synopsys, Tanium, Telesign,TE Connectivity, TensTorrent, Tobii Technology, Teradata,T-Mobile, Treasure Data, Twitter, Unity Technologies, UiPath, Verizon Communications, VAST Data, Ventana Micro Systems, Vidyo, VMware, Wave Computing, Wellsmith, Xilinx, Zayo, Zebra, Zededa, Zendesk, Zoho, Zoom, and Zscaler. Moor Insights & Strategy founder, CEO, and Chief Analyst Patrick Moorhead is an investor in dMY Technology Group Inc. VI, Fivestone Partners, Frore Systems, Groq, MemryX, Movandi, and Ventana Micro., MemryX, Movandi, and Ventana Micro.

Read the full article here