ProMerchant Editor’s Score: 8.9/10

| Pricing | 8 |

|---|---|

| Contract | 10 |

| PCI compliance | 9 |

| Early-termination fee | 10 |

| Fast deposits | 7.5 |

Why ProMerchant Is Best for Startups

Many payment processors avoid working with startups because they are new companies with uncertain outlooks and little to no financial history to consider during the application process. ProMerchant, however, has developed a reputation as a company with a fast and easy approval process, even for startups and other businesses considered high risk by most payment processors. In addition to startups, ProMerchant works with restaurants, retailers and e-commerce businesses, even in industries that most credit card processing companies would avoid.

ProMerchant also assigns customers a dedicated support team that’s available around the clock to provide personalized guidance. For startups, this means having a direct point of contact through the ups and downs of starting and growing a new business. That can be invaluable in a payment processing partner, and it’s a big reason we chose ProMerchant as the best credit card processor for startups.

Pros

- ProMerchant is willing to work with new and riskier businesses, including those with less-than-ideal credit.

- The application process is fast and easy, with approval typically occurring within 72 hours.

- There are no monthly fees, and free hardware and 24/7 customer support are included.

Cons

- As a relatively new company, ProMerchant doesn’t have a long track record.

- The processing fee structure is not listed on ProMerchant’s website, so potential customers must contact the company for a quote.

Usability

ProMerchant partners with several payment processing vendors for its software and hardware.

For mobile payments, you get free access to the PayAnywhere app and card reader. This lets you accept credit card information anywhere, even without an internet connection. The PayAnywhere app has a sleek user interface that we found easy to navigate.

PayAnywhere’s smartphone app is a simple way for merchants to process card payments and manage all types of transactions. Image source: ProMerchant

For e-commerce businesses, ProMerchant partners with Authorize.net, a well-known payment gateway. We found Authorize.net to be simple and intuitive, and it’s a great option for seamless integration with an e-commerce platform. [Read related article: Stripe vs. Authorize.net: Credit Card Processing Comparison]

Hardware offered through ProMerchant comes from well-known vendors. The PAX A920 payment terminal, in particular, is known for its user-friendly design and intuitive interface. New restaurant merchants get a free, easy-to-use Ingenico Desk 3500 credit card terminal with advanced security and super-fast processing speed, while phone/mail order merchants process customers’ keyed-in transactions easily and swiftly through the Payments Hub Virtual Terminal.

Read our article on how credit card machines work for more information and frequently asked questions.

ProMerchant Features

|

Monthly contracts |

ProMerchant’s month-to-month agreement gives you flexibility and peace of mind instead of being locked into a long-term contract. There are no long-term contracts, setup fees, application costs or cancellation fees. |

|---|---|

|

Industry-specific solutions |

EMV- and NFC-ready credit card terminals offer fast processing, making ProMerchant ideal for restaurants and retailers. |

|

Payment options |

Your customers can pay through their phone, by mail order/telephone order (MOTO) or virtually through an e-commerce shopping cart, which means that ProMerchant covers every form of payment processing. |

|

POS system |

ProMerchant’s terminals also feature a point-of-sale (POS) system to help you manage your customers, employees and inventory. The processor offers merchants the Clover POS system for seamless payment processing at low rates. |

|

High-risk options |

ProMerchant has a high approval rate, which is crucial for businesses that operate in risky sectors. Once you fill out the online application form, an account director will evaluate your business, recommend the best plan for you and contact you with a free quote. |

|

Security |

All of ProMerchant’s hardware and software solutions are PCI compliant and offer fraud protection. |

Monthly Contracts

Some credit card processors require you to sign up for a multiyear agreement — like what we found in our Merchant One review, which requires merchants to sign a three-year contract — and then hit you with a hefty early-termination fee if you cancel before the end of the term. ProMerchant operates strictly on a month-to-month basis, so you’re free to cancel at any time. If you do choose to cancel, there is no early-termination fee. This flexibility is a huge advantage for small businesses that want to try out the service without making a long-term commitment.

Many credit card processors require annual or multiyear agreements, but ProMerchant offers month-to-month service with no setup, application or cancellation fees. Learn what to look for in your credit card processing service agreement.

Industry-Specific Solutions

ProMerchant offers payment processing solutions to companies in a wide variety of industries. When you contact the company to receive your free quote, an account director will make recommendations based on your industry and the size of your business.

ProMerchant’s terminals are ideal for restaurants and retailers that need to process credit card transactions quickly. The company offers useful features, such as NFC-enabled contactless smartphone payment, inventory management tools and flexible APIs for third-party software integrations, to ensure you can operate your business quickly and efficiently.

Hardware options include the Ingenico Desk 3500 and the PAX A920, both of which are offered for free to new customers. These processing solutions are reliable, easy to use and have cutting-edge technology so you can successfully process credit cards from your customers.

The PAX A920 smart terminal has a colorful and easy-to-read touch screen, variety of peripheral ports, and the necessary capabilities to service customers anywhere. Image source: ProMerchant

Payment Options

ProMerchant offers Bluetooth wireless credit card readers that are EMV compliant and utilize NFC technology. This means you can accept credit card payments whether you and your staff are working behind a cash register or moving throughout the store.

You can also accept payments over the phone or through mail order. The virtual terminals enable quick and secure keyed-in transactions, and you can save customer information for future transactions. For e-commerce, the company provides a shopping cart integration with a flexible API.

Funds are typically deposited into your account within two business days. If you process and settle your transactions by 8:30 pm ET, you can get funded the next day.

POS System

If you’re looking for a flexible and reliable POS system, ProMerchant has you covered. All of its POS systems are fully customizable, EMV compliant, utilize NFC technology and have additional features to help you manage your customers, employees and inventory.

ProMerchant works with Clover POS hardware to give merchants a seamless payment processing experience with low rates. Learn more about this solution in our Clover POS review, or find other options in our roundup of the best POS systems.

Options for High-Risk Accounts

If you’re considered a high-risk merchant – either because of your credit score or your industry – it can be difficult to find a credit card processor that is willing to work with you. But ProMerchant has a high approval rate, even for high-risk companies such as credit repair, internet marketing, student loan consolidation, multilevel marketing, pharmaceutical and hemp businesses. That means you have a good chance of being approved, whatever your industry or business type. [Read related article: 5 Credit Card Security Risks Small Businesses Need to Know About]

Not every processor will work with high-risk businesses, such as check-cashing services and even restaurants and mobile businesses in some cases. ProMerchant does work with some high-risk companies, though, and is more likely to approve them than many other processors in our review.

Security

All of ProMerchant’s hardware and software solutions are PCI compliant. This means the company meets the highest data security standards for the payment card industry.

To maintain PCI compliance, business owners must fill out a yearly self-assessment and conduct quarterly scans of their processing solutions. This keeps your customers’ information safe and reduces your liability. [Learn more about PCI compliance for small businesses that accept credit cards.]

All terminals provided by ProMerchant provide NFC technology and EMV compliance. They offer fraud protection services and end-to-end encryption to secure payment information. These features mitigate the security issues that many businesses encounter.

ProMerchant Pricing

ProMerchant offers two main pricing plans: one with an interchange-plus rate and one with a flat rate.

- Interchange Plus Fixed Rate: With the Interchange Plus Fixed Rate plan, you will pay a flat fee and a fixed percentage on all transactions. Once you lock in your rate, it will not change for the duration of the plan. This will make it easier for you to anticipate your monthly costs and plan for future expenses. [Read related article: Effective Tips for Negotiating Lower Credit Card Processing Fees]

- Zero Cost Processing: With this plan, you’ll pay a flat percentage rate and the same fee for all transactions. There are no subscription or membership fees and no hidden costs.

ProMerchant deducts the interchange fees and percentage rates from your daily transaction batches. Expect a debit on your transaction fees (per transaction) plus your monthly charges from your account between the 5th and 7th of every month.

It’s difficult to get a complete picture of costs just by looking at ProMerchant’s website. Instead, you must contact the company directly for a free quote. We prefer when pricing is listed on the provider’s website.

The Interchange Plus Fixed Rate plan makes budgeting and financial projections easier, but you’ll likely save on per-transaction costs if you choose the Zero Cost Processing plan.

Setup

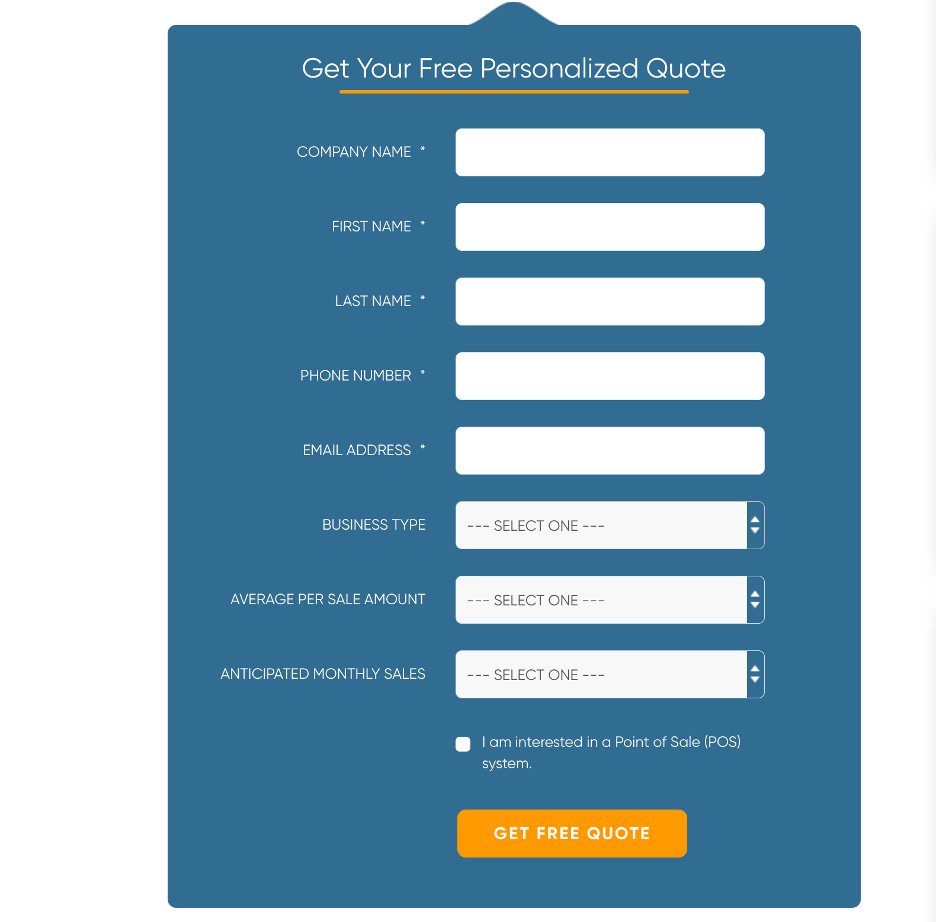

First, you must fill out ProMerchant’s free, no-obligation form. After that, it will evaluate your business and recommend the best plan for you, and then one of its account directors will contact you with a free quote.

Once you fill out and submit the online application form, one of ProMerchant’s account directors will review your request and reach out to you with a free quote. Image source: ProMerchant

The application process is fairly straightforward, and most companies will know whether or not they are approved within two to 24 hours.

Following approval, ProMerchant will send you instructions on accessing your account once you receive your equipment via overnight mail. A business owner can go from application to processing transactions within 72 hours. If you run an e-commerce or mail order/telephone order (MOTO) business, you’ll receive your processing solution securely online and start taking card payments within 48 hours. Merchants can also set up an online account and view their statements on ProMerchant’s website.

Customer Service

We found that ProMerchant maintains robust customer support. Immediately after you sign up, you’ll receive access to a personalized support team. We tested this by applying online, and an account director responded to our request via email within an hour. This team will be available to you 24/7 by phone and email as long as you remain a ProMerchant customer.

ProMerchant offers technical support through phone and email. Unlike other credit card processors that we reviewed, ProMerchant does not include a live chat feature, and it doesn’t maintain a knowledge base of FAQs.

ProMerchant has limited customer reviews online, but those that are available are overwhelmingly positive. Where negative reviews exist, the company often takes the time to respond to and resolve any complaints or issues.

Drawbacks

As a relatively new company, ProMerchant doesn’t boast the long track record of more established credit card processing companies. When it comes to security, it is ideal for companies to have a solid track record. That said, ProMerchant doesn’t appear to have had any problems handling customers’ needs in its short history.

Additionally, ProMerchant’s pricing isn’t transparent, and there is no free trial for new customers. Instead, the company requires you to reach out to customer support for a quote. That is not the norm, as many competitors list their pricing on their website. To receive a quote, you must contact a sales representative, which can be inconvenient. Many of our best picks also offer a free trial, which ProMerchant does not (though it does allow you to cancel anytime).

Another drawback to consider is ProMerchant’s lack of proprietary hardware and applications. Customers may find themselves working with products and services from several third-party vendors, which could create some issues.

Methodology

To conduct our review of ProMerchant’s credit card processing service, we looked at its partnerships with third-party hardware and software vendors and assessed these products individually. In addition, we analyzed ProMerchant’s website, marketing materials and customer reviews. To make our decision, we zeroed in on criteria such as affordability, ease of use and features relevant to small businesses. In the end, we chose ProMerchant as the best pick for startups due to its fast approval time, multiple processing solutions and willingness to take on business owners who don’t have a stellar credit score.

ProMerchant FAQs

How much does ProMerchant cost?

ProMerchant doesn’t charge monthly fees, but it does charge a transaction processing fee; two fee structures are available.

Does ProMerchant offer a free trial for credit card processing services?

No, ProMerchant does not offer a free trial, but you can cancel anytime with no penalty.

Is ProMerchant trustworthy?

We found that ProMerchant scores well on many customer review sites. However, as a newcomer in the payment processing space, ProMerchant doesn’t have a long track record.

Overall Value

We recommend ProMerchant for …

- Startups and businesses in high-risk industries or with a low credit score that want to be up and running with a processor within a few days.

- Restaurants and retailers that want to take advantage of specialized solutions and free hardware.

- Budget-conscious businesses that want to avoid monthly subscriptions and early-termination fees.

We don’t recommend ProMerchant for …

- Business owners who want a more established credit card processor with a long track record.

- Businesses that require advanced functionality and features beyond what a typical credit card processor offers.

- Merchants who prefer a one-stop shop for their payment processing needs, without the requirement of additional hardware or software.

Read the full article here